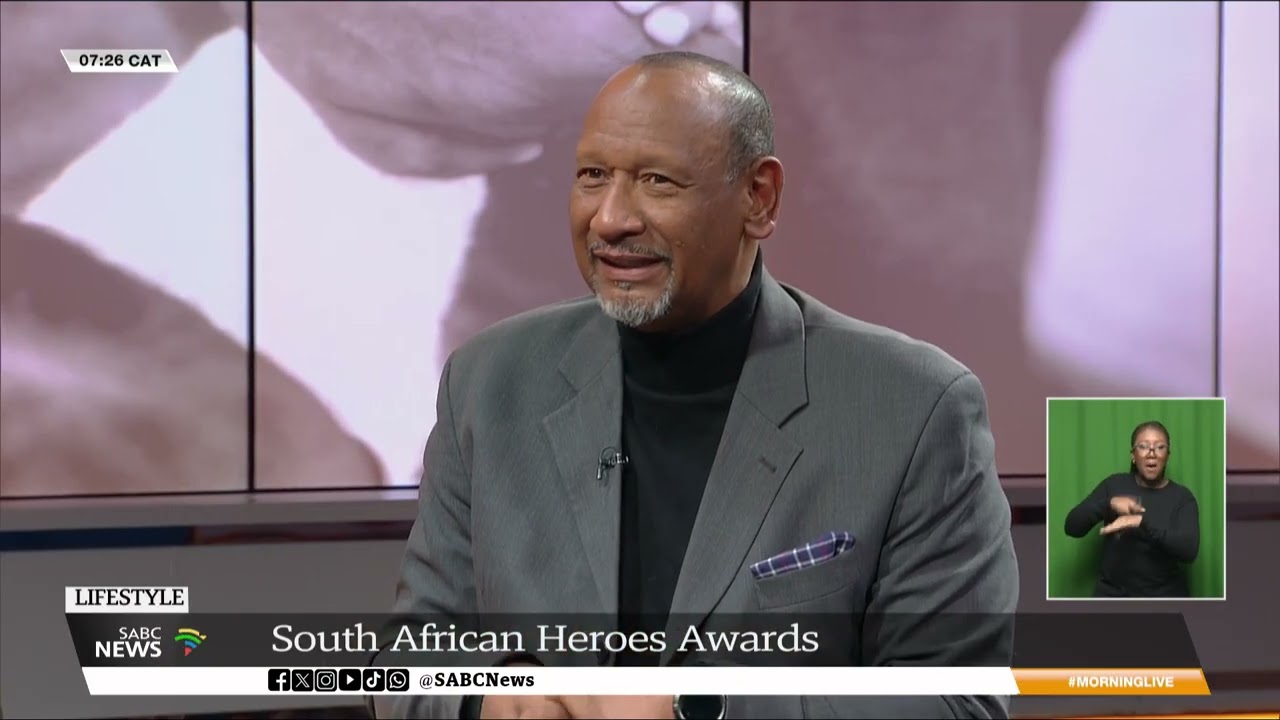

Africa Analysis MD Dobek Pater

Africa Analysis MD Dobek PaterThere are growing concerns that should the Competition Tribunal uphold a recommendation by the Competition Commission that Vodacom’s multibillion-rand deal to buy fibre operator Maziv be blocked, it would have a severely negative impact on the telecommunications industry.

Tribunal hearings into the proposed acquisition by Vodacom South Africa of up to a 40% stake in fibre player Maziv – the parent of Vumatel and Dark Fibre Africa – are nearing a conclusion, with closing arguments scheduled to be heard next month.

The Competition Commission shocked the industry last August when it recommended that the transaction be blocked on competition grounds.

When the tribunal hearings began in May, Adv Daniel Berger argued on behalf of the commission that the tribunal should uphold its recommendation on the grounds that the merged entity would monopolise the connectivity market to the detriment of smaller operators and consumers.

But industry experts are concerned that South Africa’s telecoms sector will suffer should the deal not go through.

“As a country, we need large telecoms operators in order to continue building infrastructure where it doesn’t yet exist and to upgrade what is already there,” said Dobek Pater, MD at Africa Analysis.

“If you look at countries similar to South Africa, we need large organisations with the ability to access lots of money and have the economies of scale to remain profitable, while at the same time providing affordable services to consumers,” he said. “The deal would be a positive in that it would create a larger entity able to pool massive resources and take advantage of synergies within the group.”

Roll-out slowed

Africa Analysis keeps a close eye on the fibre market in South Africa and, according to Pater, the roll-out of fibre infrastructure, especially to lower-income communities, has slowed considerably in the recent past. None of these companies has demonstrated sustainable profitability, he said.

Vumatel, a Maziv-owned company, has made big inroads into lower-income communities through its Vuma Reach and Vuma Key products. However, according to Pater, the company has accumulated billions of rand in debt and requires fresh capital to continue with its deployments.

“The problem of connectivity to low-income areas has not been solved. To solve it, you need to throw money at it, and you also need scale to ensure that these services can be provided to these communities sustainably.”

Read: Commission argues Vodacom, Maziv deal must be blocked

The commoditisation of connectivity has meant that data prices have been on a downward trend for years – and consumers are not willing to pay more. Unlike densely populated regions in places likes Europe, however, South African mobile and fibre operators must contend with vast geographies where getting the infrastructure to the consumer costs more but the return on investment is lower.

According to Pater, the only feasible way to advance South Africa’s connectivity goals while providing low-cost connectivity sustainably is if the telecoms operators have sufficient scale.

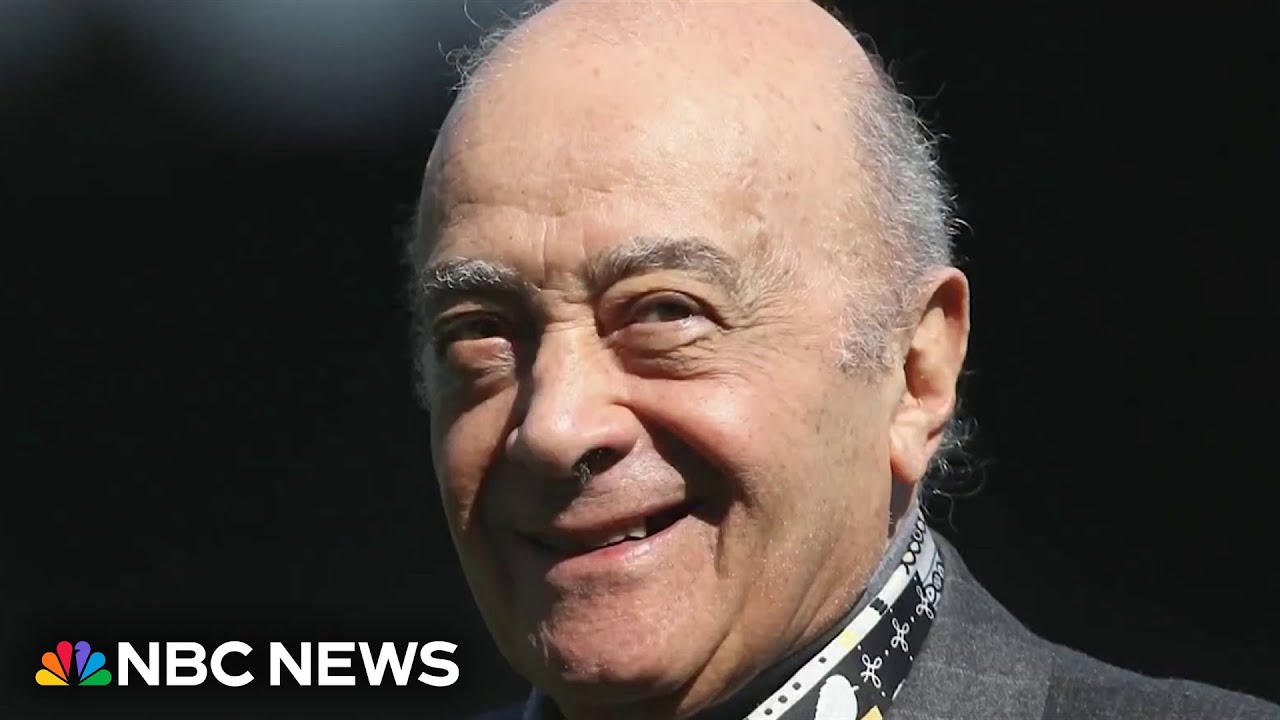

CIVH chairman Pieter Uys

CIVH chairman Pieter UysHe said approval by the Competition Tribunal of the Vodacom/Maziv deal will lead to further consolidation in the market, with MTN South Africa likely either to make another play for Telkom-owned Openserve or to seek to acquire another operator like MetroFibre.

Consolidation in the telecoms sector is not unique to South Africa. In more mature markets, including Europe, the US and Canada, there has been a trend towards two or three large players in the infrastructure space, complemented by a wider range of fibre internet service providers and mobile virtual network operators.

Pater warned that the risks of anticompetitive behaviour in a consolidated market must be dealt with through regulation, by attaching conditions to deals like the one between Vodacom and Maziv.

Adv Berger, for the Competition Commission, argued at the tribunal hearings that Vodacom’s acquisition of Maziv would lead to “self-preferencing behaviour” that would eventually price smaller players out of the market. But Pater said that should the deal be blocked, smaller players would end up being forced out of the market because they lack the scale (and financing) to sustain their operations profitably.

Petrus Potgieter, Unisa professor of decision sciences and an associated partner at telecoms consultancy Strand Consult, told TechCentral that blocking the Vodacom/Maziv deal would have detrimental consequences for investment in the local telecoms market in the longer term.

He said consolidation makes sense and is partly the result of operators making less money on value-added services like voice; now they only charge consumers for infrastructure access and “all the revenue is going to cloud and streaming service providers”.

In stasis

Potgieter is also critical of the delays in getting the deal over the line. The commission, and now the tribunal, have kept the deal in stasis for two years. This uncertainty has caused both parties to pause further investments while awaiting an outcome.

“This has a chilling effect on investment and is simply unacceptable as it creates tremendous uncertainty. This is not such an enormous deal. It may look that way in the South African context, but it really isn’t, and it shouldn’t create such as fuss. A merger of Vodacom and MTN? Now that would warrant a big fuss,” he said.

Pieter Uys, chairman of Remgro-controlled CIVH, which owns Maziv, told TechCentral that the tribunal proceedings have provided the merging parties and other industry role players with an opportunity to explore the likely effects of the proposed transaction.

“The merger parties are positive that the proposed transaction will allow Maziv to contribute to accelerated economic and socioeconomic development and to the closing of the digital divide through the provision of affordable internet to the people of South Africa as soon as possible,” said Uys. – © 2024 NewsCentral Media

“The merger parties are positive that the proposed transaction will allow Maziv to contribute to accelerated economic and socioeconomic development and to the closing of the digital divide through the provision of affordable internet to the people of South Africa as soon as possible,” said Uys. – © 2024 NewsCentral Media

1 month ago

78

1 month ago

78