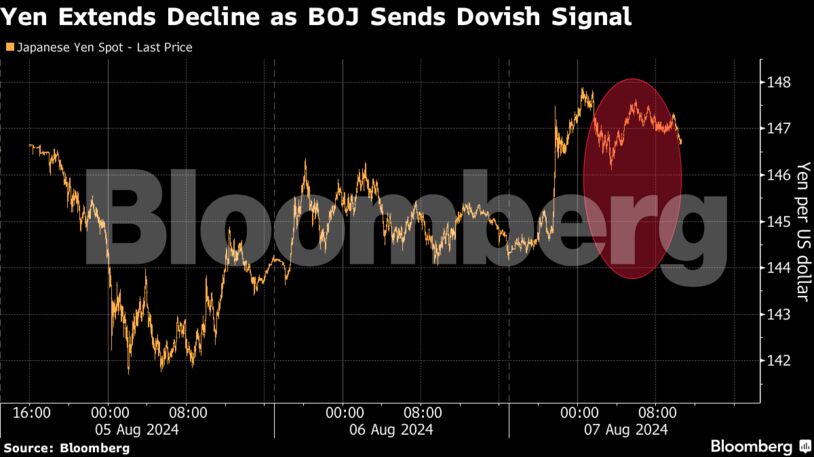

Japan’s reassurance came on the heels of massive swings in the country’s stock prices over the past week, as benchmark indexes plunged into bear markets before rebounding sharply. The moves were compounded by the view the Federal Reserve would cut rates more aggressively, prompting traders to rapidly unwind once-popular yen-funded carry trades — including crowded positions in US tech stocks.

“Investors are making a more sober assessment of the events over the past week or so,” said Fawad Razaqzada at City Index and Forex.com. “That’s not to say we are completely out of the woods just yet. But there’s at least some stabilisation in the markets, which should allow some markets to re-align with the fundamentals.”

The S&P 500 rose 1.3%. The Nasdaq 100 climbed 1.5%. The Russell 2000 of small firms added 0.6%. Meta Platforms Inc. is selling high-grade bonds. Micron Technology Inc. is resuming a buyback program. Super Micro Computer Inc. tumbled on disappointing earnings. Airbnb Inc. headed toward its biggest-ever plunge on a weak outlook.

Treasury 10-year yields advanced four basis points to 3.94%. That’s ahead of a $42 billion US auction. The Japanese yen fell 2%.

Markets have been in a tailspin amid recent weak US data, but it’s still too soon to suggest the economy is heading for a downturn, according to Franklin Templeton Institute.

After 10-year Treasury yields plunged to near 3.7% – from near 4.5% earlier this year – “it makes sense to us to take some profit,” Stephen Dover wrote.

US Treasury yields are probably too low in the absence of “broad-based evidence that an acute deterioration is underway in either the labor market or in market function,” according to strategists at Goldman Sachs Group Inc.

“The case for a meaningful rally from here is that one (or both) of those risks materialize,” William Marshall and Bill Zu wrote. “Under more benign outcomes, we think the center of gravity for yields is likely to be above current levels across the curve, in relative parallel versus the forwards.”

To Will Compernolle at FHN Financial, Treasury yields are now comfortably higher than their Monday lows, projecting a sense of calm after financial markets went haywire at the beginning of this week.

“It’s too early to declare the chaos over, however, and Treasury yields could veer back lower during light August trading and a relative data vacuum the rest of this week.” he said. “Some analysts estimate the carry trades that started a big Nikkei selloff are only halfway unwound. And without any first-tier data before the Aug. 14 release of the July CPI, Treasuries could struggle to find a firm footing.”

Corporate Highlights:

- Walt Disney Co. gave a mixed picture as it reported third-quarter results on Wednesday, with weakness at its famed theme parks offsetting its first-ever profit in streaming.

- Shopify Inc. reported second-quarter sales and profit that beat analysts’ estimates, showing that the Canadian e-commerce company is managing to navigate cautious consumer spending.

- CVS Health Corp. lowered its 2024 earnings outlook for the third straight quarter and announced cost-cutting measures to save $2 billion over several years as health-care expenses continue to soar.

- Ride-hailing company Lyft Inc. posted second-quarter bookings and issued an outlook that fell short of Wall Street’s expectations.

- Boeing Co. is redesigning the fuselage component that blew out of a nearly new 737 Max 9 aircraft mid-flight in January, as the planemaker seeks to draw lessons from the accident that has thrown it into crisis.

- Novo Nordisk A/S reported disappointing sales of its blockbuster weight-loss treatment Wegovy, a rare setback for the Danish drugmaker as it braces for more competition in the booming market.

- Rivian Automotive Inc. is sticking with a full-year vehicle production target unchanged from last year, but its chief executive officer expects output to grow in 2025 even with a plant shutdown looming.

- Brookfield Asset Management Ltd. said its assets under management rose to a record of approximately $1 trillion, and it reported profit that increased from a year ago but still missed analysts’ expectations.

Key events this week:

- Germany industrial production, Thursday

- US initial jobless claims, Thursday

- Fed’s Thomas Barkin speaks, Thursday

- China PPI, CPI, Friday

This is a modal window.

The media could not be loaded, either because the server or network failed or because the format is not supported.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 1.3% as of 10:42 a.m. New York time

- The Nasdaq 100 rose 1.5%

- The Dow Jones Industrial Average rose 0.9%

- The Stoxx Europe 600 rose 1.6%

- The MSCI World Index rose 1.3%

- Bloomberg Magnificent 7 Total Return Index rose 1.3%

- The Russell 2000 Index rose 0.6%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was unchanged at $1.0931

- The British pound rose 0.2% to $1.2719

- The Japanese yen fell 1.7% to 146.84 per dollar

Cryptocurrencies

- Bitcoin fell 1.4% to $55,760.11

- Ether fell 4.7% to $2,371.67

Bonds

- The yield on 10-year Treasuries advanced four basis points to 3.94%

- Germany’s 10-year yield advanced six basis points to 2.26%

- Britain’s 10-year yield advanced three basis points to 3.95%

Commodities

- West Texas Intermediate crude rose 2.5% to $75.02 a barrel

- Spot gold rose 0.5% to $2,402.29 an ounce

1 month ago

68

1 month ago

68